Medicare Part D: What It Covers, How It Works, and What You Need to Know

When you’re on Medicare Part D, the federal prescription drug coverage program for Medicare beneficiaries. It’s not automatic—you have to pick a plan, and choosing wrong can cost you hundreds or even thousands a year. Many people think it’s just about getting pills covered, but it’s really about managing costs, avoiding coverage gaps, and knowing which drugs are in your plan’s formulary.

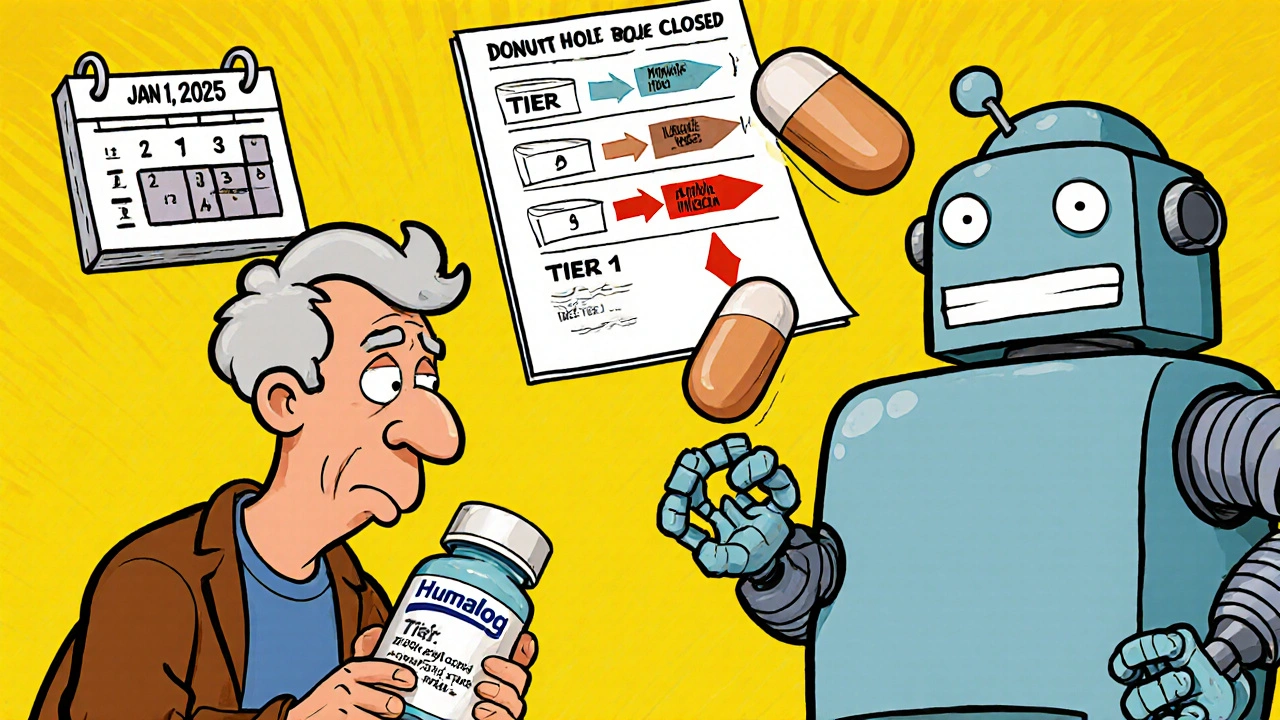

Prescription drug coverage, what Medicare Part D provides through private insurers approved by Medicare. Part D plans vary widely. One plan might cover your blood pressure med at $5 a month, while another charges $45. Some have high deductibles, others have no deductible but higher copays. You can’t just pick the cheapest plan—you need to check if your exact drugs are listed and at what tier. If your favorite medication isn’t covered, you might pay full price or file a special exception request. And don’t forget the donut hole. That’s the coverage gap where you pay more out of pocket after you and your plan spend a certain amount. In 2024, you hit the donut hole after $5,030 in total drug costs. Once you’re in, you pay 25% of the cost for brand-name and generic drugs until you hit the catastrophic coverage threshold.

Medicare insurance, the government health program for people 65 and older or those with certain disabilities. Original Medicare (Parts A and B) doesn’t cover most prescriptions you pick up at the pharmacy. That’s where Part D steps in. You can get it as a standalone plan (PDP) or bundled with your Medicare Advantage plan (MAPD). If you don’t sign up when you’re first eligible and go without creditable coverage for more than 63 days, you’ll pay a late enrollment penalty forever—usually 1% extra per month for every month you delay. And if you’re on low income, you might qualify for Extra Help—a federal program that cuts your Part D costs dramatically. It covers premiums, deductibles, and copays. You don’t have to be broke to qualify—many people with modest savings still get it.

What you’ll find in the posts below isn’t theory. It’s real-world stuff: how to read your drug formulary, how to spot dangerous interactions between your prescriptions and OTC meds, how to switch plans without losing coverage, and what to do when your insurer denies your drug. You’ll see how people manage polypharmacy with multiple meds, how to avoid liver damage from acetaminophen combos, and how to handle drug allergies without getting stuck without treatment. These aren’t generic guides—they’re the exact problems people face when navigating Part D, and how to fix them.

Insurance Changes and Generic Switching: How Formulary Updates Affect Your Prescription Costs in 2025

Understand how 2025 Medicare formulary updates are pushing patients toward generics and biosimilars, what it means for your prescription costs, and how to protect yourself from unexpected drug switches and price hikes.