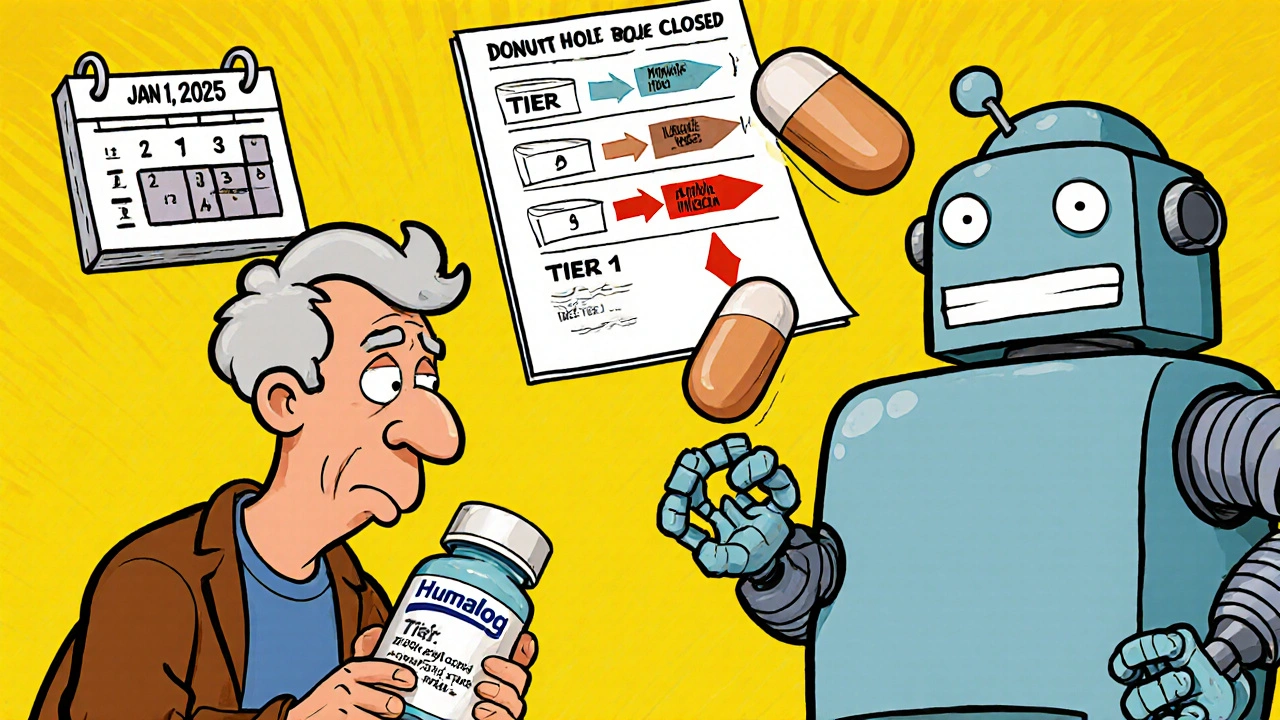

When your insulin or arthritis medication suddenly costs three times more, it’s not a glitch-it’s a formulary update. Every year, especially starting January 1, 2025, insurance plans and pharmacy benefit managers (PBMs) change which drugs they cover, how much you pay, and sometimes, which exact version of a drug you’re allowed to use. For millions of people on Medicare Part D, these changes aren’t just paperwork-they’re life-altering. You might not get the brand you’ve been taking for years. Instead, you’ll be switched to a generic or biosimilar, often without your doctor’s input. This isn’t about savings for the insurer alone. It’s about whether you can afford to keep taking your medicine at all.

What Exactly Is a Formulary Update?

A formulary is a list of drugs your insurance plan covers. It’s divided into tiers, and each tier has a different price tag. In 2025, the structure is clearer than ever:- Tier 1: Preferred generics-usually $1 to $10 per prescription.

- Tier 2: Non-preferred generics and some preferred brands-around $47.

- Tier 3: Non-preferred brands-$113 on average.

- Specialty Tier: High-cost drugs like cancer treatments or biologics-$113 or 25% coinsurance.

Why Are Insurers Switching You to Generics?

It’s not personal. It’s financial. A single brand-name biologic like Humira can cost over $7,000 a month. Its biosimilar, Amjevita, costs about $3,500. That’s a 50% drop. For insurers managing millions of prescriptions, that adds up to billions in savings. So they move the brand to a higher tier-or remove it entirely-and put the generic or biosimilar in Tier 1. CVS Caremark, one of the biggest pharmacy benefit managers, removed nine specialty drugs from its 2025 formulary and added 18 new ones, including biosimilars like Kanjinti and Trazimera to replace older, more expensive versions. UnitedHealthcare moved Humalog insulin to a higher tier, causing some members to see their copays jump from $35 to $113 overnight. These aren’t mistakes. They’re calculated moves. But here’s the catch: not all generics are created equal. A generic version of a pill like metformin is identical to the brand. But biosimilars-like Amjevita instead of Humira-are highly similar, but not identical. They’re made from living cells, not chemicals. That means even tiny differences can matter for people with autoimmune diseases. Some patients report no change. Others feel worse. And insurers don’t always ask before switching you.Non-Medical Switching: When Your Insurance Decides Your Treatment

"Non-medical switching" is when your insurer changes your drug for cost reasons, not because your doctor thinks it’s better. It’s legal. And it’s rising. According to healthcare attorney Scott Glovsky, cases of non-medical switching jumped 23% in 2024. You could be stable on a drug for years, then get a letter in the mail saying your coverage is changing. No discussion. No trial. Just a new prescription. This is especially dangerous for people with chronic conditions-diabetes, rheumatoid arthritis, Crohn’s disease. A sudden switch can trigger flare-ups, hospital visits, or worse. One Reddit user, "MedicareWarrior87," wrote: "My copay for Humalog jumped from $35 to $113 overnight. I had to choose between insulin and groceries." On the flip side, many people benefit. "ArthriticMom" on HealthUnlocked shared: "I switched from Humira to Amjevita. Saved $450 a month. No difference in how I feel." That’s the ideal outcome. But it shouldn’t be left to chance.

What You Can Do: Four Steps to Protect Yourself

You can’t stop formulary changes. But you can control how they affect you. Here’s how:- Check your formulary between October and December. Every insurer sends out a Summary of Coverage (SOC) by October 1. Don’t ignore it. Look up every medication you take. If your drug moved to a higher tier or was removed, act now.

- Ask your pharmacist. Pharmacists see formulary changes daily. They know what alternatives are covered and which ones have the best track record. Ask: "Is there a generic or biosimilar that’s covered and safe for me?"

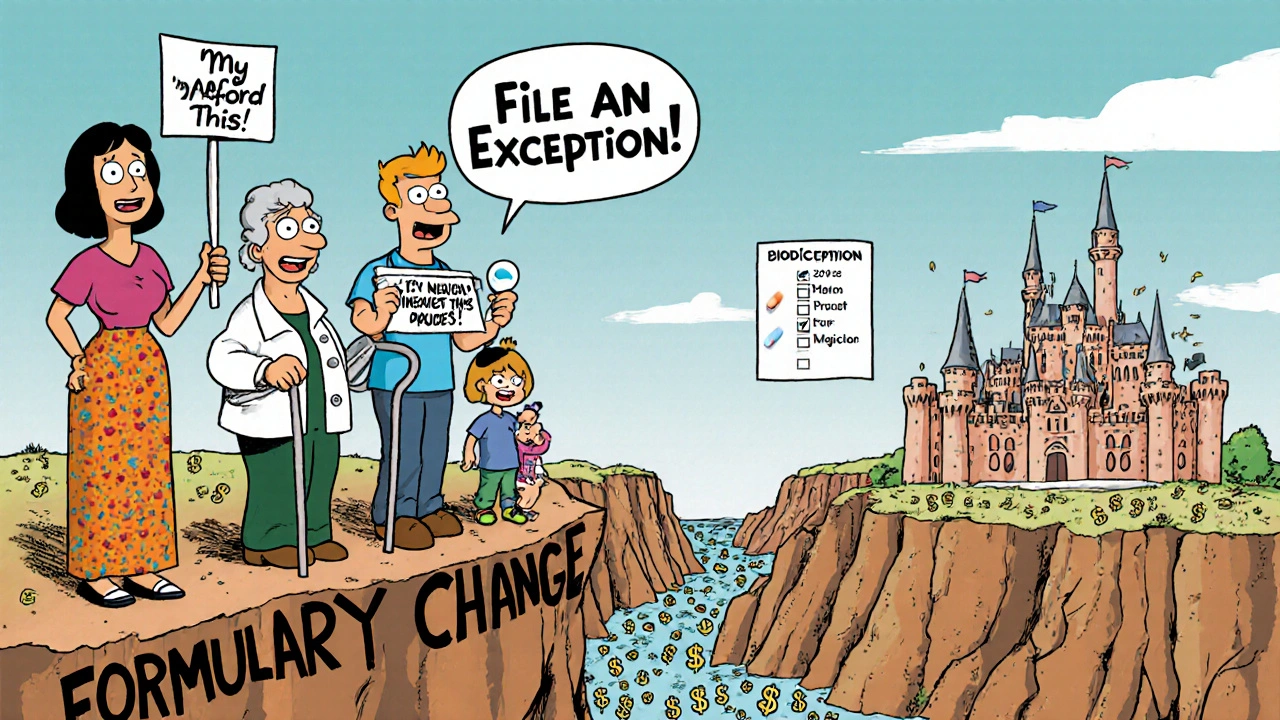

- Request an exception. If your drug was removed or moved to a higher tier, your doctor can file a formal exception request. There are two types: standard (takes 72 hours) and expedited (24 hours if your health is at risk). In 2024, 82% of tiering exceptions were approved. But only 47% of requests to reinstate a completely excluded drug got through.

- Use your 30-day transitional supply. If your plan changes your drug, you’re entitled to a 30-day supply of your old medication at the old price. Use that time to get your exception approved or switch safely.

The Big Shift Coming in 2026

2025 is just the warm-up. In January 2026, Medicare Part D plans will be required to cover 10 specific drugs that the government negotiated lower prices for. These include Stelara (ustekinumab), Prolia (denosumab), and Xolair (omalizumab). Insurers can’t exclude them. That’s huge. But here’s the twist: they’ll still push biosimilars hard. By 2026, 65% of plans are expected to require generic substitution wherever possible. The FDA is also accelerating approval of biosimilars. In 2024 alone, 17 new ones were approved-up 34% from the year before. Experts predict biosimilars will make up 45% of targeted therapy prescriptions by 2027, up from 28% in 2024. That means more switches, more savings, and more pressure on patients to adapt.

Who Gets Left Behind?

The system works well for people who are informed, proactive, and have strong doctor support. But not everyone can navigate this. Elderly patients without tech access may miss their SOC notices. People with multiple chronic conditions may struggle to manage multiple switches. Those without reliable transportation or caregivers can’t easily switch pharmacies or get exceptions processed. Dr. Karen Ignagni, former CEO of America’s Health Insurance Plans, warned: "Over-aggressive generic substitution could disrupt chronic disease management for vulnerable populations if not implemented with clinical oversight." She’s right. Cost savings shouldn’t come at the cost of health.What’s Next? Stay Ahead of the Changes

Formulary updates aren’t going away. They’re becoming more frequent, more complex, and more tied to federal policy. Your best defense is awareness. - Set a calendar reminder for October 1 each year. That’s when your plan’s new formulary drops. - Keep a printed list of all your medications, including dosages and why you take them. Bring it to every appointment. - Talk to your doctor about your concerns. Ask: "If my drug gets switched, what’s the backup plan?" - If you’re on a specialty drug, consider joining a patient advocacy group. They track formulary changes and help with appeals. The system is designed to save money. But it shouldn’t be designed to make you sick. You have rights. You have options. And you’re not alone.What should I do if my insurance switches my medication without telling me?

If your medication was changed without notice, contact your pharmacy and your insurer immediately. You’re entitled to a 30-day transitional supply of your old drug. Ask for a copy of your plan’s formulary update notice. If it wasn’t sent 60 days in advance (as required by CMS), file a complaint with Medicare. Then, work with your doctor to submit an exception request. Don’t stop taking your medication unless instructed by a healthcare provider.

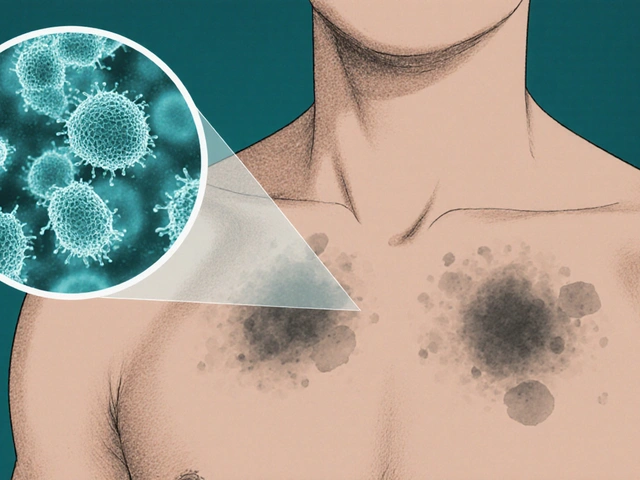

Are biosimilars as safe as brand-name drugs?

Yes, for most people. Biosimilars are rigorously tested by the FDA to be "highly similar" to the original biologic, with no clinically meaningful differences in safety or effectiveness. However, because they’re made from living cells, not chemicals, a small percentage of patients may respond differently. If you’ve been stable on a brand-name drug like Humira, talk to your doctor before switching. Monitor for changes in symptoms after the switch. Most people experience no issues, but it’s not a one-size-fits-all solution.

Can I be switched to a generic if I’m allergic to something in it?

Yes, but you can fight it. Insurers can’t force you to take a drug that contains an ingredient you’re allergic to. Your doctor must document the allergy and submit an exception request. The plan must approve it. If they deny it, you can appeal to Medicare. Never assume your allergy will be ignored. Be proactive. Keep your allergy list updated with every provider and pharmacist.

Why do some drugs get excluded entirely from formularies?

Drugs are often excluded because they’re expensive and have cheaper, equally effective alternatives. Insurers use data to decide which drugs are "redundant" or "low-value." For example, if three similar drugs exist, and two are generics, the third brand-name drug might be cut. The goal is to reduce spending without reducing health outcomes. But sometimes, the excluded drug is the only one that works for a specific patient. That’s why exception requests are critical.

Will my drug costs really be capped at $2,000 in 2025?

Yes, for Medicare Part D enrollees. Starting January 1, 2025, you won’t pay more than $2,000 out-of-pocket for covered drugs in a calendar year, regardless of how expensive your medications are. This includes all copays, coinsurance, and what you pay in the coverage gap. This cap applies only to drugs covered by your plan. If your drug isn’t on the formulary and you don’t get an exception, it doesn’t count. But for most people on chronic meds, this will be a major financial relief.

Sam Jepsen

November 24, 2025 AT 15:56Man, I just got hit with a switch from Humira to Amjevita last month. Thought I was gonna crash hard, but honestly? I feel the same. Saved like $500 a month. My pharmacist said most people don’t notice a difference, but if you do, speak up. Don’t just suffer in silence. You got rights.

Also, set a reminder for October 1. Seriously. I missed it last year and it cost me a week of panic and extra doctor visits. Don’t be me.

Yvonne Franklin

November 26, 2025 AT 05:10Formulary changes are a nightmare but you can fight back. Request exceptions. Use the 30-day rule. Talk to your pharmacist. Done.

Stop waiting for someone to fix it for you.

Michael Fitzpatrick

November 28, 2025 AT 04:36You know what’s wild? This whole system was built on the idea that generics are just as good, and for most people they are. But then you hear stories like MedicareWarrior87 and it hits different. I’ve got a cousin on insulin, and she’s been stable for five years. If they switched her tomorrow, she’d lose her job. Not because she’s lazy, but because her body’s not a spreadsheet.

And yeah, the $2k cap is huge, but it doesn’t help if your drug’s not on the list. And that’s where the real pain is. The system rewards the ones who can navigate it, and punishes the ones who are tired, old, or just don’t have time to fight.

I don’t know the answer, but I know we need more transparency. Like, actual plain language notices. Not 40-page PDFs no one reads.

Also, can we talk about how PBMs are basically middlemen who take a cut and then act like they’re saving us money? It’s wild.

Holly Schumacher

November 28, 2025 AT 12:59Let me be perfectly clear: this isn’t about cost savings. It’s about corporate greed disguised as policy. Insurers don’t care if you flare up, get hospitalized, or die. They care about their quarterly earnings. The FDA approves biosimilars based on statistical averages-not individual biology. And yet, they force you to take them anyway.

And don’t get me started on the ‘exception request’ loophole. 82% approval rate? That’s only if you have a doctor who cares enough to fight. What about the elderly? The undocumented? The ones without internet access? They’re being sacrificed on the altar of profit.

And yes, I’ve seen the ‘I feel fine’ testimonials. Those are the lucky ones. The rest are silent. Because they can’t afford to speak up. They’re choosing between insulin and rent.

This isn’t healthcare. It’s a market experiment with human lives as lab rats.

Daniel Jean-Baptiste

November 28, 2025 AT 19:10My mom got switched from her arthritis med last year and she was terrified. We called the pharmacy, found out the new one was covered, and she tried it. Took a week. She was fine. No drama.

But I know not everyone’s like that. If you’re worried, ask your doc. Bring a list. Don’t assume anything. And if they change your med without telling you, call them. They have to give you 30 days. Use it.

Also, October 1 is your friend. Mark it. Set a phone alert. Even if you think you’re fine now, things change fast.

Rahul Kanakarajan

November 30, 2025 AT 06:12People complain about switching but never check their own formulary. You think insurance is out to get you? Nah. You’re just lazy. If you don’t read the fine print, you deserve what you get.

Also, biosimilars work. Stop being a drama queen. I’ve been on them for 3 years. No issues. Your body is fine. Your mindset is the problem.

New Yorkers

November 30, 2025 AT 15:08Capitalism doesn’t care if you live or die. It only cares if you’re profitable. The $2,000 cap? A PR stunt. The real power is in the formulary. The real villain isn’t the insurer-it’s the system that lets them decide who gets to live.

They’ll never fix this until we burn it all down. Until then, you’re just a line item in a ledger.

And yes, I’ve seen the ‘I feel fine’ posts. They’re the ones who still have jobs. The rest? They’re ghosts now.

David Cunningham

December 2, 2025 AT 01:32Been through this twice now. Switched from Enbrel to a biosimilar. Felt weird for two weeks. Then fine. Saved $400/month. My GP didn’t even mention it until I asked. Just sent the script.

Best thing? I started asking my pharmacist every time I pick up. They know the formulary better than the docs sometimes. Also, if you’re on a specialty med, join a patient group. They’ll tell you before the letter even arrives.

And yeah, October 1 is sacred now. I set a calendar invite. It’s not paranoia. It’s survival.

luke young

December 3, 2025 AT 23:48Just wanted to say thanks to the person who wrote this. I’ve been too scared to look at my plan’s formulary because I was afraid of what I’d find. But now I’m gonna check it. I’ve got a friend who had to stop her med last year and ended up in the ER. I don’t want that to be me.

Also, the 30-day rule is a lifesaver. I didn’t even know that existed. Thanks for the practical steps. This feels less hopeless now.

Jessica Correa

December 4, 2025 AT 01:46I’m on a biosimilar now and honestly I didn’t notice anything different. But I get why people are scared. My aunt had a bad reaction to a generic thyroid med once and it took months to fix. So I totally get the fear.

What helped me was writing down every med I take and asking my pharmacist: ‘Is this the same thing, just cheaper?’ They always tell me the truth.

And yeah, October 1. I’m setting a reminder right now. I’m not waiting for another surprise.